Introduction to Brexit and Its Economic Context

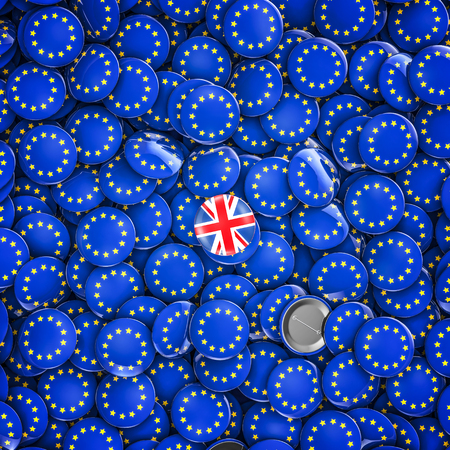

Brexit, a portmanteau of “British exit,” refers to the United Kingdom’s historic decision to leave the European Union following the 2016 referendum. This watershed moment in British history was shaped by years of political debate and public discourse about national sovereignty, economic independence, and regulatory autonomy. On 31 January 2020, the UK officially departed from the EU, concluding nearly five decades of membership and triggering a period of significant transition. In the immediate aftermath, Britain faced economic volatility marked by fluctuations in the value of sterling, uncertainty in investment markets, and disruptions across multiple sectors. Regulatory frameworks, previously harmonised with EU standards, entered a phase of redefinition as the UK government sought to establish its own rules on trade, finance, and environmental policy. The ramifications of this seismic shift are especially pertinent to sustainable and ethical investing. Investors and institutions alike have had to navigate an evolving landscape where established norms are being rewritten and new opportunities—and risks—are emerging. As Britain forges its path outside the EU, understanding the context and consequences of Brexit is essential for anticipating how sustainable and ethical investment practices will develop in this new era.

2. Defining Sustainable and Ethical Investing in the UK

Sustainable and ethical investing, as understood in the British context, goes beyond simply avoiding harm; it actively seeks to contribute positively to society and the environment. These investment approaches have become increasingly significant in Britain, especially as the country repositions itself post-Brexit. Investors, asset managers, and regulators now face a unique landscape shaped by evolving British values and emerging regulatory frameworks.

What Does Sustainable and Ethical Investment Mean in Britain?

In the UK, sustainable investment typically aligns with Environmental, Social, and Governance (ESG) criteria. However, ethical investment is often more values-driven, reflecting distinctly British concerns such as workers’ rights, climate action, animal welfare, and corporate transparency. The expectation is for investments not only to generate financial returns but also to uphold standards that resonate with local societal priorities.

Key Regulatory Influences

The regulatory environment for sustainable and ethical investing in Britain has been influenced by both EU legacy regulations and new UK-specific rules introduced post-Brexit. Two main frameworks shape the field:

| Framework | Description | Relevance Post-Brexit |

|---|---|---|

| EU Sustainable Finance Disclosure Regulation (SFDR) | Previously applied during EU membership; required transparent ESG disclosure from investment products. | Still influences some cross-border funds but being replaced by UK-specific standards. |

| UK Sustainability Disclosure Requirements (SDR) | Aims to ensure consistent sustainability reporting across UK financial markets. | Developed to reflect British priorities; expected to diverge further from EU rules over time. |

Local Values and Investor Expectations

Britain’s approach is shaped by a tradition of stewardship—there is an ingrained sense of responsibility among investors towards communities and future generations. Recent surveys suggest that UK investors increasingly expect their portfolios to reflect values like fair employment practices, decarbonisation commitments, and robust governance. This local perspective means that British sustainable investing often takes on a pragmatic tone: blending commercial ambition with a genuine desire for positive impact.

In summary, defining sustainable and ethical investing in the UK involves understanding a distinct mix of regulatory requirements, cultural values, and investor expectations. As Brexit continues to influence the legislative environment, British investors must navigate both legacy EU rules and emerging domestic frameworks while maintaining their commitment to responsible investment principles.

3. Regulatory Changes Post-Brexit: Challenges and Opportunities

Brexit has brought about a significant shift in the regulatory landscape for sustainable and ethical investing within Britain. As the UK disentangled itself from the European Union, it gained the autonomy to craft its own regulations and frameworks tailored to local priorities. This newfound independence presents both challenges and opportunities for responsible investors operating in Britain.

The most notable change is the divergence from EU-wide standards such as the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy for sustainable activities. While these frameworks provided a unified approach across member states, they were sometimes criticised in the UK for lacking flexibility or failing to address distinctly British economic sectors, like domestic real estate or renewable energy infrastructure.

In response, the UK government has launched its own initiatives, including proposals for a UK Green Taxonomy and a bespoke Sustainability Disclosure Requirements (SDR) regime. These efforts aim to provide clarity for investors while reflecting UK-specific priorities, such as a strong focus on climate risk transparency and a pragmatic approach to social governance issues. However, there is also concern among market participants about potential confusion or increased compliance costs arising from having to navigate separate regulatory regimes when investing across both UK and EU markets.

Despite these challenges, the opportunity to tailor regulation could foster innovation in sustainable finance products that better align with British values and needs. For example, UK policymakers are exploring ways to incentivise investment in regional regeneration and levelling-up projects—initiatives that might not have received equivalent recognition under prior EU rules. Additionally, there is scope for faster regulatory adaptation as global best practices in ESG evolve.

Ultimately, while Brexit has created uncertainty during this transition period, it has also empowered Britain to shape a regulatory environment that can support long-term sustainable growth and ethical investment on its own terms. The coming years will be crucial as regulators, investors, and companies work together to ensure these new frameworks strike the right balance between ambition and practicality.

4. The Role of British Institutions and Investor Confidence

Since Brexit, British financial institutions have been compelled to reassess their strategies around sustainable and ethical investing. The UK’s exit from the EU has meant a divergence from shared regulatory frameworks such as the EU Sustainable Finance Disclosure Regulation (SFDR). This shift has presented both challenges and opportunities for domestic banks, asset managers, and pension funds in terms of compliance, innovation, and global competitiveness.

Adaptation by Key Players

Major UK-based financial institutions are now tasked with aligning their sustainability standards to both local regulations and international expectations. Pension funds, traditionally seen as long-term stewards of capital, have become especially prominent in driving ESG (Environmental, Social, Governance) priorities. However, the lack of a unified framework post-Brexit creates uncertainty regarding best practices and disclosures.

Institutional Response Overview

| Institution Type | Post-Brexit Actions | Key Challenges |

|---|---|---|

| Banks | Developing UK-specific green bonds, integrating climate risk assessments | Navigating fragmented regulations; maintaining global credibility |

| Pension Funds | Increasing allocations to renewable infrastructure; stakeholder engagement | Lack of clarity on sustainable definitions; performance pressures |

| Asset Managers | Customising ESG products for UK market; advocacy for clearer guidance | Client education; adapting to shifting reporting requirements |

Investor Confidence in a New Era

The British public’s perception of sustainable investing has evolved alongside these institutional changes. While there is growing awareness about environmental and social issues, investor confidence remains closely tied to transparency and trust in regulatory oversight. Post-Brexit uncertainties over the UK’s direction on green finance have made some investors cautious, though others view this as an opportunity for Britain to set its own ambitious agenda.

A Balancing Act Ahead

The challenge for British institutions lies in balancing robust ESG integration with ongoing market competitiveness. Building investor confidence will depend on clear communication, credible standards, and visible impacts from sustainable investment initiatives. As the UK carves out its own path, the ability of its financial sector to adapt innovatively will be crucial for the future landscape of ethical investing in Britain.

5. International Collaboration and Market Access

Britain’s departure from the European Union has fundamentally reshaped its position within the global ethical investment landscape. Traditionally, EU membership facilitated seamless access to a vast single market and a regulatory framework that supported cross-border sustainable finance initiatives. Post-Brexit, British investors and asset managers face both new challenges and unique opportunities in forging international collaborations and maintaining market access.

One of the most immediate impacts is the loss of passporting rights, which previously allowed UK financial firms to operate freely across Europe. This regulatory shift means British sustainable investment products must now comply with separate EU regulations, often requiring costly duplication of compliance efforts. For ethical investment funds—where transparency, standardisation, and trust are critical—this can hinder both fundraising and cross-border project development.

Despite these obstacles, Britain remains a global financial powerhouse, and there are promising signs that it can pivot towards broader international cooperation outside the EU framework. The UK government has expressed ambitions to position London as a world-leading centre for green finance by aligning with global standards such as those set by the Task Force on Climate-related Financial Disclosures (TCFD). Moreover, opportunities exist to strike bilateral agreements with non-EU markets, tapping into emerging economies where demand for sustainable investment is growing rapidly.

However, developing new partnerships is not without its difficulties. The divergence in regulatory approaches between the UK and EU may create uncertainty for international investors seeking consistency. In addition, Britain must work harder to demonstrate credibility and leadership in global forums to ensure it remains influential in shaping future sustainable finance norms.

In sum, while Brexit has introduced complexity into Britain’s engagement with the international ethical investment community, it also offers a chance to innovate, diversify partnerships, and lead on a truly global stage. The coming years will test whether the UK can successfully balance independence with meaningful collaboration to advance sustainable and ethical investing at home and abroad.

6. Outlook for Sustainable and Ethical Investing in Britain

Looking ahead, the landscape of sustainable and ethical investing in post-Brexit Britain is set to be shaped by a unique mix of opportunities and obstacles. While regulatory divergence from the EU may present challenges, it also offers scope for innovative policymaking tailored to the UK’s specific priorities. The British government has signalled its intent to position the City of London as a global centre for green finance, and there is strong potential for growth as institutional investors and consumers increasingly prioritise environmental and social governance (ESG) factors.

Emerging Trends and Market Dynamics

We can expect continued mainstreaming of ESG principles across investment portfolios, driven by both societal demand and international market pressures. The UK’s independent stance may allow for more agile responses to emerging sustainability standards, although consistency with global frameworks will remain crucial for attracting cross-border capital. Additionally, fintech innovation is poised to play a pivotal role; digital platforms could democratise access to sustainable investment products, while blockchain technology may enhance transparency in ESG reporting.

Challenges on the Horizon

The road ahead is not without its hurdles. One significant challenge will be maintaining robust yet flexible regulation that encourages innovation but does not compromise on ethical or environmental standards. Uncertainty around future trade agreements and evolving EU-UK relations could affect investor confidence and complicate compliance for multinational firms operating within Britain. Furthermore, education remains essential—empowering retail investors with reliable information about sustainable options will help drive broader participation.

Prospects for Growth and Leadership

Despite these uncertainties, Britain has an opportunity to lead by example. By fostering collaboration between government, industry, and civil society, the UK can develop a financial ecosystem that rewards responsible business practices and supports long-term societal wellbeing. Incentives such as green bonds, tax reliefs for sustainable investments, and clearer disclosure requirements are likely to spur further innovation. As the sector matures, those institutions able to blend profitability with genuine ethical commitment will set new benchmarks—not just for Britain but potentially as a model internationally.