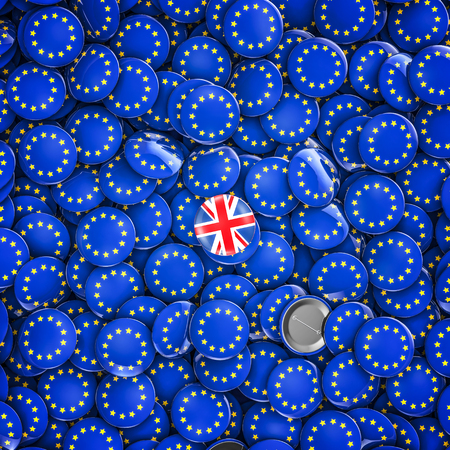

Developing a UK-centric Approach to ESG Data Collection and Assurance

Understanding the UK Regulatory LandscapeAs ESG (Environmental, Social, and Governance) considerations take centre stage in corporate strategy, organisations operating in the UK face a rapidly evolving regulatory environment. The UK government has demonstrated a strong commitment to sustainable finance by embedding ESG principles into legislation and financial market practices. Notably, the Financial Conduct Authority (FCA)…