Understanding Social Impact Investing in the UK

Social impact investing has gained remarkable traction across the United Kingdom, emerging as a dynamic approach that seeks to generate positive social and environmental outcomes alongside financial returns. At its core, social impact investing refers to the allocation of capital into projects, organisations, or funds with the explicit intention of addressing societal challenges—be it through supporting affordable housing initiatives, fostering education opportunities, or championing green technologies. In the British context, this movement has evolved significantly over the past decade, shaped by both governmental policy and grassroots innovation.

The origins of social impact investing in the UK can be traced back to a blend of philanthropic tradition and progressive policy-making. The establishment of entities such as Big Society Capital in 2012 marked a pivotal moment, providing dedicated funding and infrastructure to catalyse the sector’s growth. Over time, a broad spectrum of investors—including private individuals, charitable foundations, pension funds, and local authorities—have become increasingly engaged with the promise of aligning their investments with their values.

The significance of social impact investing within the UK extends beyond its financial implications. It reflects a growing awareness that investment capital can be harnessed as a force for good, actively contributing to solutions for entrenched issues such as inequality, environmental degradation, and community cohesion. For investors, it offers an avenue to pursue long-term value that transcends traditional profit metrics; for society at large, it represents a collaborative effort towards more inclusive and sustainable development. As this guide will explore further, understanding the principles underpinning social impact investing is essential for anyone looking to make a meaningful difference in Britain’s ever-evolving landscape.

2. Core Principles and Frameworks

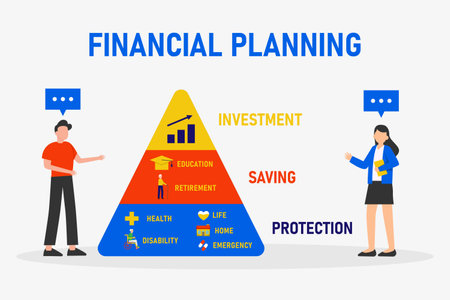

Social impact investing in the UK is underpinned by a set of core principles that guide both investors and organisations towards sustainable, measurable outcomes. These principles ensure that financial decisions are not solely driven by profit but also by a commitment to generating positive social or environmental change. The three fundamental principles at the heart of UK social impact investing are intentionality, measurement of impact, and transparency.

Intentionality

Intentionality refers to the deliberate pursuit of social or environmental objectives alongside financial returns. UK-based investors and organisations articulate their intended impact clearly, often aligning their objectives with national priorities such as reducing inequality, improving access to education, or promoting environmental sustainability.

Measurement of Impact

The measurement of impact is crucial for maintaining accountability and ensuring that investments are achieving their stated goals. In the UK, organisations typically use robust frameworks to track and report on their social impact. This process involves setting key performance indicators (KPIs), collecting data, and conducting regular evaluations.

| Principle | Description |

|---|---|

| Intentionality | Clear articulation of desired social/environmental outcomes |

| Measurement | Systematic tracking and evaluation of impact metrics |

| Transparency | Open reporting on investment processes and outcomes |

Transparency

Transparency is a cornerstone for building trust among stakeholders. UK organisations are expected to provide comprehensive disclosures about their investment processes, criteria for selecting initiatives, and the outcomes achieved. This openness fosters confidence among both investors and beneficiaries.

Prevailing Frameworks in the UK

A variety of frameworks help standardise how impact is defined, measured, and communicated within the sector. Some of the most widely adopted frameworks in the UK include:

| Framework | Description |

|---|---|

| Social Return on Investment (SROI) | A methodology that assigns a monetary value to social outcomes to assess overall value created |

| UN Sustainable Development Goals (SDGs) | A global blueprint used locally as reference points for setting targets and measuring progress |

| Impact Management Project (IMP) | An initiative offering guidance on classifying, measuring, and managing impact across portfolios |

The Role of Regulatory Bodies

The Financial Conduct Authority (FCA) and Big Society Capital play significant roles in shaping standards for impact investing within the UK. Their guidelines encourage best practices in transparency, due diligence, and reporting—ensuring that investments align with both investor values and wider societal needs.

3. Opportunities in the UK Market

Prominent Sectors Driving Social Impact

The UK has emerged as a vibrant hub for social impact investing, with several sectors demonstrating substantial growth and innovation. One of the most dynamic areas is community development. Across regions, local enterprises and social ventures are revitalising high streets, fostering inclusive employment, and supporting vulnerable populations. Initiatives such as Community Investment Funds enable investors to back projects with tangible social value while generating steady returns.

Affordable Housing: Addressing Critical Needs

The ongoing challenge of affordable housing presents significant opportunities for impact-driven capital. With growing demand for quality homes at accessible prices, impact investors are collaborating with housing associations, local councils, and private developers to bridge funding gaps. Innovative financing models—such as shared ownership schemes and social lettings agencies—are gaining momentum, aiming to provide secure tenancies and uplift communities in both urban and rural settings.

Renewable Energy: Powering Sustainable Futures

The transition to a low-carbon economy remains a key priority for the UK. Investments in renewable energy—spanning wind, solar, and community-led energy projects—have accelerated. These ventures not only contribute to environmental goals but also generate local jobs and reduce fuel poverty. The government’s commitment to net zero emissions by 2050 continues to drive investor interest and policy support within this sector.

Current Trends Shaping the Landscape

The integration of technology in social ventures is reshaping traditional models, from fintech solutions for financial inclusion to digital health platforms addressing inequality in healthcare access. There is also increased attention on aligning investments with the UN Sustainable Development Goals (SDGs), providing frameworks for measurable impact.

Future Growth Areas

Looking ahead, areas such as circular economy initiatives, early years education, and mental health services are poised for further growth. Impact investors are increasingly drawn to scalable solutions that combine strong evidence bases with robust impact measurement tools. As regulatory clarity improves and new blended finance vehicles emerge, the UK market is set to offer even broader opportunities for those seeking both financial returns and positive societal outcomes.

4. Navigating the Regulatory and Policy Landscape

The regulatory and policy environment for social impact investing in the UK is both dynamic and robust, reflecting the nation’s commitment to harnessing finance for public good while maintaining investor protection and market integrity. A clear understanding of the legal framework, government initiatives, and recent legislative shifts is essential for investors aiming to operate successfully in this sector.

Legal Foundations and Regulatory Bodies

Social impact investing in the UK is shaped by a combination of general financial regulations and specific policies designed to foster sustainable investment. Key regulatory bodies include the Financial Conduct Authority (FCA), which oversees conduct in the financial markets, and the Charity Commission, which regulates registered charities involved in social investment. These authorities ensure that investment products are transparent, risks are appropriately managed, and that organisations meet their legal obligations.

Regulatory Considerations

| Aspect | Details |

|---|---|

| Financial Promotions | Subject to FCA rules; must be clear, fair, and not misleading. |

| Charity Law | Charities must demonstrate that investments align with their charitable objectives. |

| Tax Relief Schemes | Initiatives like Social Investment Tax Relief (SITR) incentivise private capital flows into social ventures. |

| Investor Protection | Due diligence requirements and risk disclosures mandated by law. |

Government Support and Strategic Initiatives

The UK government has positioned itself as a global leader in social impact investing. Through entities such as Big Society Capital—a wholesale social investor—and targeted funding programmes, policymakers have created an enabling environment for innovative financing models. The government’s mission-led business review and creation of the Inclusive Economy Partnership further underline its ongoing commitment.

Recent Legislative Developments

- SITR Extension: The Social Investment Tax Relief scheme has been extended to stimulate investment into eligible social enterprises.

- Pension Fund Guidance: The Department for Work & Pensions (DWP) has issued guidance encouraging pension funds to consider social impact as part of their fiduciary duties.

- Community Interest Companies (CICs): Legal structures specifically designed for enterprises with a social purpose are increasingly popular due to their clarity around asset locks and stakeholder accountability.

Challenges Ahead

Despite these positive developments, challenges remain. Regulatory complexity can deter new entrants, while changes in government policy or economic headwinds may influence investor confidence. Maintaining a balance between innovation and prudent oversight will be critical as the sector matures.

5. Challenges and Risks

While social impact investing in the UK presents exciting prospects, it is not without its challenges. Investors must navigate a landscape that is continually evolving, with complexities unique to the sector.

Measurement Complexity

One of the most significant hurdles is the accurate measurement of social impact. Unlike traditional financial returns, social value is nuanced and multifaceted. There is no universally accepted framework for impact assessment, which can make it difficult for investors to compare opportunities or track progress against objectives. Many UK-based organisations are working towards standardised reporting, but the current diversity in methodologies often leads to inconsistency and ambiguity.

Balancing Returns: Social versus Financial

Another key challenge lies in balancing financial performance with social outcomes. Investors may face pressure to prioritise one over the other, particularly during periods of economic uncertainty. The UK’s regulatory environment encourages responsible investing, yet expectations around acceptable returns can differ greatly among stakeholders. This tension requires long-term thinking and clear communication between investors, investees, and beneficiaries.

Fostering Meaningful Partnerships

Effective social impact investing relies on strong partnerships across sectors—public, private, and third sector organisations must collaborate closely. However, building trust and alignment between diverse partners can be time-consuming and complex. Cultural differences in organisational priorities or operational styles often present obstacles to effective cooperation. Investors must be adept at relationship management and open dialogue to ensure partnerships deliver genuine impact.

Navigating Market Immaturity

The UK’s impact investing market continues to mature, but certain areas still lack depth or liquidity. This can result in limited deal flow or exit options for investors seeking scalable solutions. Early-stage ventures may also face challenges accessing appropriate funding or support networks.

Regulatory Uncertainty

Finally, while the UK government has shown consistent support for social investment initiatives, changes in policy or regulation may introduce uncertainty. Keeping abreast of legislative developments and adapting investment strategies accordingly is essential for long-term resilience.

Tackling these challenges calls for patience, ongoing learning, and a willingness to adapt—qualities that will serve investors well as they seek to generate sustainable social impact throughout the UK.

6. Building a Sustainable Future Through Social Impact Investing

As we look to the future, social impact investing stands at the forefront of shaping a more inclusive and sustainable society across the UK. The momentum behind this approach is driven by a growing recognition that financial returns and positive societal change are not mutually exclusive, but rather, can be mutually reinforcing.

Long-Term Outlook: Systemic Change on the Horizon

The long-term outlook for social impact investing in the UK is promising. With ongoing support from government initiatives, evolving regulatory frameworks, and increasing engagement from both institutional and retail investors, there is clear potential for systemic change. This investment philosophy encourages capital to flow towards enterprises and projects addressing key challenges—from affordable housing and healthcare to education and environmental sustainability—thus fostering resilient communities and narrowing inequality gaps.

The Role of Innovation and Collaboration

Sustained success will depend on continual innovation and cross-sector collaboration. Partnerships between public bodies, private investors, charities, and social enterprises are essential in scaling effective solutions. As data collection and impact measurement techniques advance, investors will be better equipped to assess outcomes and refine their strategies for even greater effect.

Guidance for Prospective Investors

For those looking to get involved in social impact investing, it is important to approach opportunities with a mindset focused on long-term value creation rather than short-term gains. Start by defining your personal or organisational values, then seek funds or projects whose missions align accordingly. Engage with established networks such as Big Society Capital or Social Investment Forum for guidance, due diligence, and peer learning. Remember that patience is essential; generating meaningful social impact often requires time and sustained commitment.

Ultimately, social impact investing offers a pathway for individuals and institutions alike to contribute to the UKs sustainable future. By balancing financial objectives with purposeful investment choices, we can collectively drive systemic change—creating lasting benefits not just for investors, but for communities across the nation.